Former Vice Minister of Finance confident in 4.5%-5% growth for 2025-2030

Zhu Guangyao affirmed China's commitment to further integration and conveyed confidence in the country's growth prospects to senior multinational executives.

Zhu Guangyao served as China's Vice Minister of Finance from May 2010 to June 2018. After joining the Ministry of Finance in 1985, he has served in various senior positions within the Ministry, including Director-General of the Department of International Economic and Financial Cooperation. From 2001 to 2004, he was the Executive Director for China at the World Bank Group.

In a speech delivered at a seminar at Renmin University of China on August 5, Zhu said with an average annual growth rate of 5.4% for 2021-2024, China would only need an average annual growth rate of 4.3% over the next eleven years to reach a total GDP of 200 trillion RMB and a GDP per capita exceeding $20,000 by 2035—a long-range goal set in 2020. He was also confident that China is on track to achieve economic growth between 4.5% and 5% in 2025 and during the 15th Five-Year Plan (2026-2030), providing greater flexibility during the 16th Five-Year Plan (2031-2035) to meet the 2035 objectives.

The Chinese transcript was first published by Guancha.cn and is also available on the official WeChat blog of the Chongyang Institute of Financial Studies, Renmin University of China.

Less than a week after the conclusion of the Third Plenary Session of the 20th Central Committee of the Communist Party of China (CPC), I met with an international delegation of entrepreneurs composed of over a dozen CEOs from multinational companies, arranged by the Chinese People's Institute of Foreign Affairs. The coordinator of this visit was Rick Waters, Managing Director of Eurasia Group's China practice, former Deputy Assistant Secretary of State for China and Taiwan, and former Head of the Office of China Coordination (China House). He organized this visit by top executives to Beijing with the aim of understanding the decisions made at the Third Plenum and their impact on both the Chinese and global economies, particularly on the business operations of their corporations.

I had a lengthy discussion with them. Their concerns, which are also the focus of our meeting today, centered on the 2029 goal—completing over 300 reforms proposed by the plenum—and the 2035 goal—establishing a high-level socialist market economic system. They recognized the importance and impact of the Decision passed by the Third Plenum and had their own assessments. However, they wanted to have a deeper understanding of these two goals.

Their first question concerns the relationship between China's economy and the global economy, particularly the impact of economic relations between China and major economies on the future world. The delegation wondered whether it is possible for two opposing blocs and two parallel supply chains to emerge globally. As the Communique of the Third Plenum emphasizes high-standard opening up, they presented some specific data and hoped to have the Chinese side analyze the content of the Communique in light of this data. I believe the data they provided is factual and objective.

First, the United States and China together account for over 45% of global GDP. In 2023, the world’s total GDP was $105 trillion, with the U.S. and China being the two largest economies. The U.S. economy stood at $27.36 trillion, while China’s was $17.66 trillion. Combined, they represent nearly 45% of the global GDP.

Second, the U.S. and China account for one-fifth of global trade. These multinational executives presented data on international trade and the distribution of global goods and services trade. In 2023, the total global trade in goods was $48 trillion and the total global trade in services amounted to $15 trillion, making a combined total of $63 trillion for goods and services. The trade volume of goods and services for both the U.S. and China is roughly the same, at $6.85 trillion each. As shown previously, in terms of economic scale, the U.S. ranks first globally and China second, with the two countries together accounting for nearly 45% of the global economy. However, out of the total global trade volume of $63 trillion, each country accounts for only $6.85 trillion.

So what exactly were these entrepreneurs concerned about? It was whether, on this basis, the U.S. and China are moving towards establishing two parallel global supply chains. The U.S. is now attempting to bring industries and manufacturing back to America by building "small yard, high fence" and providing special subsidies, particularly in the semiconductor and electric vehicle sectors. Through various measures, including export controls and economic and trade sanctions against China, the U.S. aims to reduce the level of economic cooperation with China. This has indeed affected the economic relations between the two countries. In this context, the situation is further complicated by the upcoming U.S. presidential election on November 6 and the 2024 Republican Party Platform which has proposed revoking China's Most Favored Nation status and imposing high tariffs on Chinese goods imported into the U.S.

The Third Plenum provided a resolute response to the world: China is unwavering in its commitment to further deepening reform and opening up. China will continue to make every effort to advance China through reform and opening up while also striving to integrate China's economy more deeply into the global economy. These entrepreneurs have a level of understanding of the Third Plenum Communique comparable to that of Chinese scholars and officials. They have studied it diligently, word by word, because, in their own words, it is closely related to their own business operations in China and their global business strategies.

These multinational entrepreneurs have drawn confidence and encouragement from the Third Plenum Communique. I also discussed with them the International Monetary Fund prediction that if the U.S. and China were to establish two parallel supply chains, this will cost the global economy 7% of GDP, with the worst-case scenario being 12%. With some quick calculations, we discovered that this negative impact on the global economy would amount to $7 trillion to $12 trillion, a burden that no country can bear.

Therefore, to answer the first question raised by these entrepreneurs, deepening reform and opening up and further integrating into the world is not only in China's best interest but also in the best interest of the world.

The second question from the entrepreneurs centers on the Communique's emphasis the Communique's emphasis that "the present and the near future constitute a critical period for our endeavor to build a great country and move toward national rejuvenation on all fronts through Chinese modernization." They expressed significant interest in understanding the meaning of these goals, the pathways to achieving them, and the means of ensuring their realization. The world needs to understand this, particularly multinational entrepreneurs, who need to know whether their business operations in China will benefit from the country's development rather than be adversely affected. This understanding is crucial to their business strategies, and they are well-acquainted with the CPC's objectives.

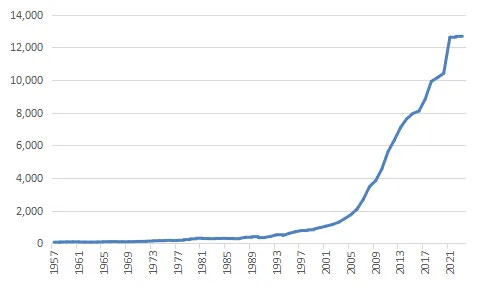

China's 14th Five-Year Plan (2021-2025) began with a total GDP of 101 trillion RMB and a GDP per capita of $10,276 in 2020. After first surpassing $10,000 in 2019, the GDP per capita further rose to $12,617 in 2021. According to the Long-Range Objectives Through the Year 2035, China aims to double its 2020 GDP per capita to $20,000, with a total GDP of 200 trillion RMB [$28 trillion]. So where does China stand now?

By the end of 2023, China's GDP reached 126 trillion RMB [$17.6 trillion], with a GDP per capita of $12,594. While China must continue building on this foundation, it is crucial to determine the annual GDP growth rate required over the 11 years from 2025 to 2035. This is a key concern for the entrepreneurs, who closely monitor these figures confirmed by both the International Monetary Fund and China’s National Bureau of Statistics.

In setting the Long-Range Objectives for 2035, China signaled to the world that it aims to double its GDP per capita from the 2020 level. Based on the data mentioned earlier, this would require an average annual GDP growth rate of 4.7% over the 15-year period from 2021 to 2035. Now, with the 14th Five-Year Plan nearly complete, the GDP growth rates for the first four years have been 8.1% in 2021, 3% in 2022, 5.2% in 2023, and an expected 5% in 2024. This results in an average annual growth rate of 5.4% for the first four years. Moving forward, statistical calculations indicate that an average annual growth rate of 4.3% over the next eleven years will be sufficient to meet the 2035 target.

I am fully confident China can reach a total GDP of 200 trillion RMB and a GDP per capita exceeding $20,000 by 2035. As I mentioned earlier, the average GDP growth rate for the first four years of the 14th Five-Year Plan is 5.4%. Next year will be pivotal as China concludes the 14th Five-Year Plan and drafts the 15th Five-Year Plan. As China is on track to achieve economic growth between 4.5% and 5% next year, and given current trends, the country is optimistic that the 15th Five-Year Plan (2026-2030) will sustain this growth range, this will allow greater flexibility during the 16th Five-Year Plan (2031-2035) to accomplish the 2035 objectives. Based on economic development patterns, national wealth accumulation, and improvements in total factor productivity, China remains confident in achieving these long-range objectives. This perspective, I told the entrepreneurs, is supported by precise calculations.

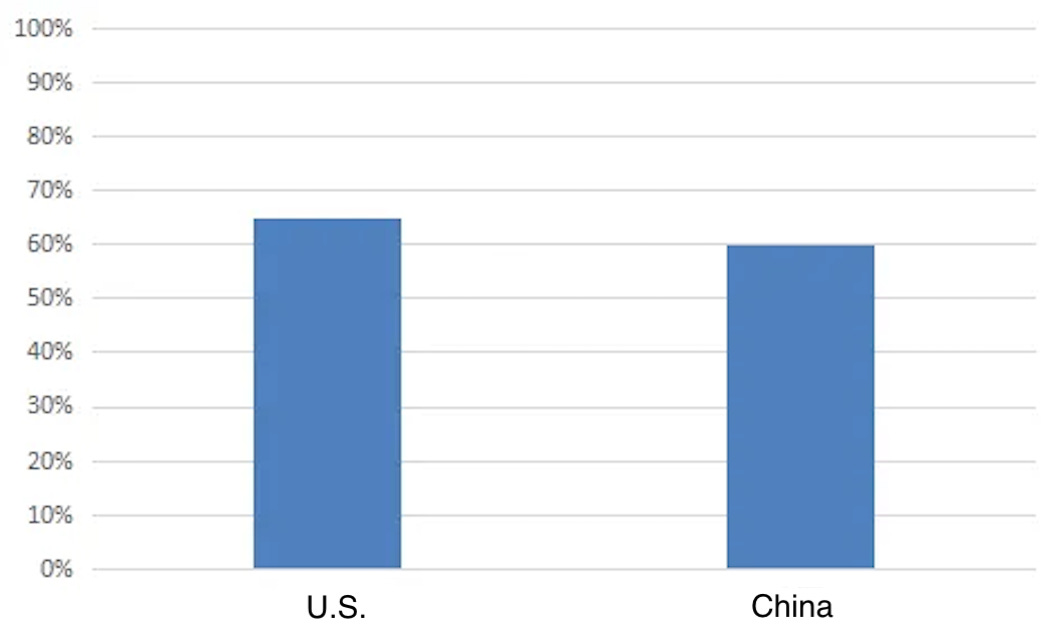

The third question, which was of great concern to the entrepreneurs, focuses on the development of "new quality productive forces." This concept involves tailoring measures to local conditions and promoting the deep integration of the real economy with the digital economy. Since the 18th CPC National Congress in 2012, China's economy has seen remarkable growth in the digital sector, guided by Xi Jinping's new development philosophy. By 2023, the digital economy accounted for 60% of China's overall GDP of $17.66 trillion, contributing $10.6 trillion. This marks a significant achievement in China's development efforts.

On the other hand, though, the scale of China's digital economy still lags behind that of the United States and Germany, where they exceed 60% and even 65%. This presents new challenges.

The first challenge facing China's digital economy is the flow of data, particularly the transmission of intercontinental data through submarine communications cables, which are critical infrastructure. The "Clean Network" program, initiated by the Trump administration in 2020, has significantly affected the speed and number of submarine cables under construction that connect to China. Given the importance of intercontinental data flow, this issue warrants close attention.

The second challenge is the current discussions around crypto assets. The U.S. launched the spot Bitcoin exchange-traded funds (ETFs) in January. Spot ether ETFs began trading in July, just last month. The 2024 Republican Party Platform clearly aims for the legalization of cryptocurrency and proposes to add Bitcoin as a strategic reserve to the US Treasury— a slogan that was part of Trump's campaign during his election run.

Due to time constraints, I cannot elaborate on how China should respond to the circumstances. From the perspective of the national industrial layout and the future development of the international financial market, strategic considerations are necessary. It is crucial to implement the strategic directives of the Third Plenum concerning the "integration of the real economy and the digital economy," as this will have significant implications for the future.