Li Yang's financial diagnosis of China's economy

The Chinese Academy of Social Sciences economist's conclusion: ONLY reform and opening-up, NOT financial and fiscal stimulus, will revitalize the economy.

Li Yang is an Academician of the Chinese Academy of Social Sciences (CASS), the ministerial-level government thinktank where the title Academician, 学部委员 in Chinese, is only granted to the most recognized social scientist.

Presiding over the National Institution for Finance & Development (NFID), formerly the CASS Financial Laboratory, Li Yang was previously a Vice President of CASS, equivalent to a vice minister in the central government. In 2015, the NIFD and 25 other institutes were higlighted as the first batch of “state high-end think tanks,” where it is the only one specializing in finance.

That is to say, Li Yang is as an authoritative economist as you can get in the Chinese state apparatus. This makes his following financial diagnosis of China's economy all the more extraordinary, given his unambiguous assessment - if not a warning - and prescription.

Li recently gave the public presentation at the 80 Years after Bretton Woods: Building an International Monetary and Financial System for All” & 2024 Tsinghua PBCSF Global Finance Forum held on May 27-28, 2024.

I don’t have Li’s slides so I took some snapshots from the live streaming of his speech on Weibo by CGTN, China’s state foreign language broadcaster.

The translation is based on the Chinese-language transcript provided to me by Tsinghua PBCSF and hasn’t been reviewed by Li. All emphasis is mine - Zichen Wang.

中国金融发展的若干问题

Several Issues in the Development of China's Finance

Distinguished guests, ladies and gentlemen, good afternoon! It is a great honor to be invited again to participate in the Tsinghua PBCSF Global Finance Forum. The topic of my speech is "Several Issues in the Development of China's Finance."

After the Central Financial Work Conference, we have developed excellent logical thinking: all financial issues should first be viewed in the context of the economy. The conference confirmed that the main problem China faces is insufficient effective demand. A significant reason for this inadequate demand is the inability to increase income. Moving forward, our primary macroeconomic policy should ensure close coordination between the two major macro-control policy systems. This is the first point I want to share with you.

[Slide’s title: Inadequate effective demand is the main problem facing the macroeconomy.]

Let’s look at some numbers. This is our macro leverage ratio. We have been publishing this figure for over twenty years, and through these figures, we can calculate many details.

[Slide’s title: Relatively low nominal GDP growth led macro leverage ratio up.]

Looking at this chart, the first impression is that the macro leverage ratio has risen quite rapidly in recent years, especially last year. There might be a misconception that an increase in the macro leverage ratio implies a rise in financial risk, which is seen as unfavorable. However, a detailed analysis of the structure shows that the leverage ratio is the quotient of the numerator (debt) and the denominator (GDP). If we calculate the corporate leverage ratio, the denominator should be corporate equity; if we calculate the household leverage ratio, it should be household disposable income; if we calculate the government leverage ratio, it is government fiscal expenditure; if we calculate the entire society, the denominator is the Gross Domestic Product (GDP).

Thus, an increase in the leverage ratio can be caused by changes in either the numerator or the denominator. Unfortunately, I must inform you that this recent rise in the leverage ratio is due to changes in the denominator, indicating a slowdown in our economic growth.

[Slide’s title: Slower growth of non-financial sector (‘real’ sector) debt can be confirmed]

To clarify, the numerator is debt. I want to emphasize that in studying finance, one should not fear discussing debt; debt is our research subject. At least for now, if our economic entities are willing to borrow and spend, that is something China greatly desires.

This chart shows that nobody is willing to borrow, resulting in slow debt growth and even slower GDP growth, leading to the current situation. The misconception that a rising leverage ratio indicates worsening financial conditions needs to be addressed. The real issue lies in the downturn of the real economy.

Next, let's examine the situation of residents, highlighting a few key points.

[Slide’s title: Growth of leverage ratio and debt in the households’ sector]

First, the leverage ratio of the Chinese household sector has risen very quickly. It began to increase significantly after the real estate market emerged at the turn of the century, leading to rapid expansion of household debt.

Second, by 2020, the leverage ratio of the Chinese household sector surpassed that of Germany and Japan. This is not necessarily a good sign. As we know, Japan experienced the so-called "lost 30 years," largely due to excessively high household leverage ratios. This situation [in China] had already begun to appear by 2020. The current issues in the real estate market, despite numerous measures, have not been effectively addressed, and the roots of these problems were planted back then.

Third, the rise in household leverage ratio last year was not because households were willing to borrow but because household disposable income dropped sharply. This chart shows various types of household borrowing last year, including consumer loans, housing loans, and personal business loans. In China, personal business loans are essentially corporate loans, representing individual businesses as production units. Originally, these loans were acceptable, but they have now uniformly declined. Economic activities in all sectors have slowed down, resulting in the overall decline in household disposable income and the subsequent rise in the leverage ratio, which deserves particular attention.

The deposit-loan gap is another frequently discussed issue in recent years. Household deposits have risen rapidly, while loans have grown slowly. For the real sector, credit is more critical than money. Money only becomes effective when it turns into loans, debts, or corporate bonds.

[Slide’s title: The increasing gap between savings and loans in the household sector.]

This chart shows that a lot of money has not turned into credit. This chart is often misunderstood or even distorted, suggesting that China has a lot of deposits and money. However, the spending habits of the wealthy differ significantly from those of the less wealthy.

Thus, the difference is particularly concerning for macroeconomy policy. We have three explanations for this situation:

1. Banks, whose main business used to be lending, now prefer buying bonds over giving loans. Banks' liabilities form the money supply, and their assets are mainly loans or bonds. Recently, banks have shown a preference for buying bonds rather than issuing loans.

2. Shadow banking has gradually disappeared. China has been very strict with shadow banking. As researchers, we believe this issue could be reconsidered since shadow banking isn't inherently bad. However, shadow banking has significantly diminished in China.

3. Many financial activities, especially those of non-bank financial institutions, are returning to the banking sector. Besides banks, which other financial institutions are thriving? Recently, I went to a bank to make a two-year deposit, and the bank said I had to wait for its plan [to give a two-year deposit to me], which is rare. China has never refused deposits, yet this situation has arisen. My conclusion is that China's financial industry is overall reverting to a bank-centric system.

We cannot outright say this is bad. Reflecting on the recent Central Financial Work Conference, our next task is to ensure that increasingly stronger and larger banks, especially state-owned banks, support the real economy as intended by the central government. This is our mission.

Corporate leverage ratios have fluctuated upward, but this increase is also passive. Corporations are not borrowing, leading to a rise in the leverage ratio. Non-financial corporate debt, including loans and corporate bonds, has decreased.

[Slide’s title: Corporate leverage ratio is also up, passively.]

Corporations are not borrowing or issuing bonds, opting instead to “lie flat”. This is one of the most pressing issues China needs to overcome and resolve.

Thus, examining the non-financial and corporate sectors, the changes in their leverage ratios warrant our attention. We must particularly explore the deep-seated reasons behind these changes, rooted in the real economy. Further analysis of corporate deposits reflects similar issues, including current and fixed deposits. Enterprises should ideally have more current deposits, ready to employ labor, pay wages, buy raw materials, and start operations, with some even prepared to invest. Unfortunately, in the past two years, we have seen enterprises turning current deposits into fixed deposits, a phenomenon that troubles us, paralleling the situation in the household sector.

[Slide’s title: Structural difference in the growth of corporate savings reflect similar problems.]

Now let's consider the government. The government leverage ratio has also risen quickly. China's government bond market is currently the second-largest in the world. This is not something to boast about; the market scale is vast, but it remains debt.

[Slide’s title: Government leverage ratio is up.]

In the chart, yellow represents local government debt. [Blue represents central government debt.] Unlike other countries, especially developed economies, our main difference is that they primarily rely on sovereign debt (central government debt), which is risk-free within a jurisdiction. However, our local debt carries risks, including market and credit risks. Therefore, in response to our government debt structure, the Central Financial Work Conference proposed four measures to establish a government debt management mechanism. The first is to prevent issues with local debt and ensure proper management of local government debt.

I urge everyone not to assume that a rising leverage ratio is bad without considering the underlying reasons. Proactive fiscal policies need to be more positive and effective. Currently, this is not the case, necessitating further discussion. From the central government's perspective, if the year-end budget is not adjusted, this year's proactive fiscal policy will likely be on par with last year's, presenting challenges for overall macroeconomic policy.

Next, let's examine the financial sector's leverage ratio, which can be calculated from both liability and asset angles.

[Slide’s title: Financial sector’s leverage ratio.]

[Yellow represents debt. Blue represents assets.]

The widening gap, with the liability side higher and growing, confirms that money is returning to banks. Shadow banking is also gradually returning to the institutional banking system.

We believe the financial leverage ratio will remain stable in the future. Although it may rise again in the short term due to slow economic recovery, it is not expected to trend upward in the long term. It is essential to note the increasing difference between assets and liabilities, indicating structural changes.

Continuing with the financial sector, the gap between bank assets and M2. M2 is often mentioned, but it provides little information. Comparing M2 to bank assets shows that M2 hasn't converted into credit.

[Slide’s title: The difference between banks’ assets and M2, showing lukewarm financing activities in the market]

[Black represents total assets of banks. Blue represents M2.]

All data points to the same conclusion: while the money supply may not be lacking, the credit supply is shrinking due to reasons in the real economy and the financial sector. Despite active monetary policies, insufficient financing demand from the real economy suppresses the rise in the financial leverage ratio.

This chart shows interbank liabilities and net lending from banks to non-bank financial institutions.

[Slide’s title: Banks’ net lending and inter-bank borrowing.]

The blue line represents net lending from banks to non-bank institutions. Previously, money was concentrated in banks, with non-bank financial institutions borrowing from banks. Now, this trend is reversing. Interbank liabilities are very low, even exceeding the money banks lend out, indicating a structural issue. The entire financial structure has changed significantly, not just potentially. Due to economic downturns and other factors, the financial leverage ratio may rise slowly in the short term.

This chart shows M2. China's monetary policy appears highly stimulative.

[Slide’s title: Stimulus from monetary policy appears strong.]

Some say China's M2 is equivalent to the combined M2 of the Federal Reserve, the European Central Bank, the Bank of England, and the Bank of Japan. However, M2 in China and elsewhere are not comparable due to different statistical standards. M2 has become an indicator with limited information. The money supply remains substantial but has not converted into credit.

Here's our calculated result: as professional researchers, we do not look at M2; we examine the proportion of M1 in M2.

[Slide’s title: But the liquidity of money supply drops.]

M0 is cash, ready to be spent anytime. M1 is M0 plus corporate current deposits, also ready for immediate use. The proportion and changes of readily usable money in the total money supply reflect overall liquidity and society-wide confidence in the economy. It is dropping. The downward trend explains the paradox of "loose monetary policy, but credit is not truly loose."

For many years, terms like "loose money, tight credit" have been coined, reflecting the low proportion of circulating money. Our former central bank governor, Dai Xianglong, once mentioned that too many deposits are idle, referring to excessive fixed deposits, which can be explained.

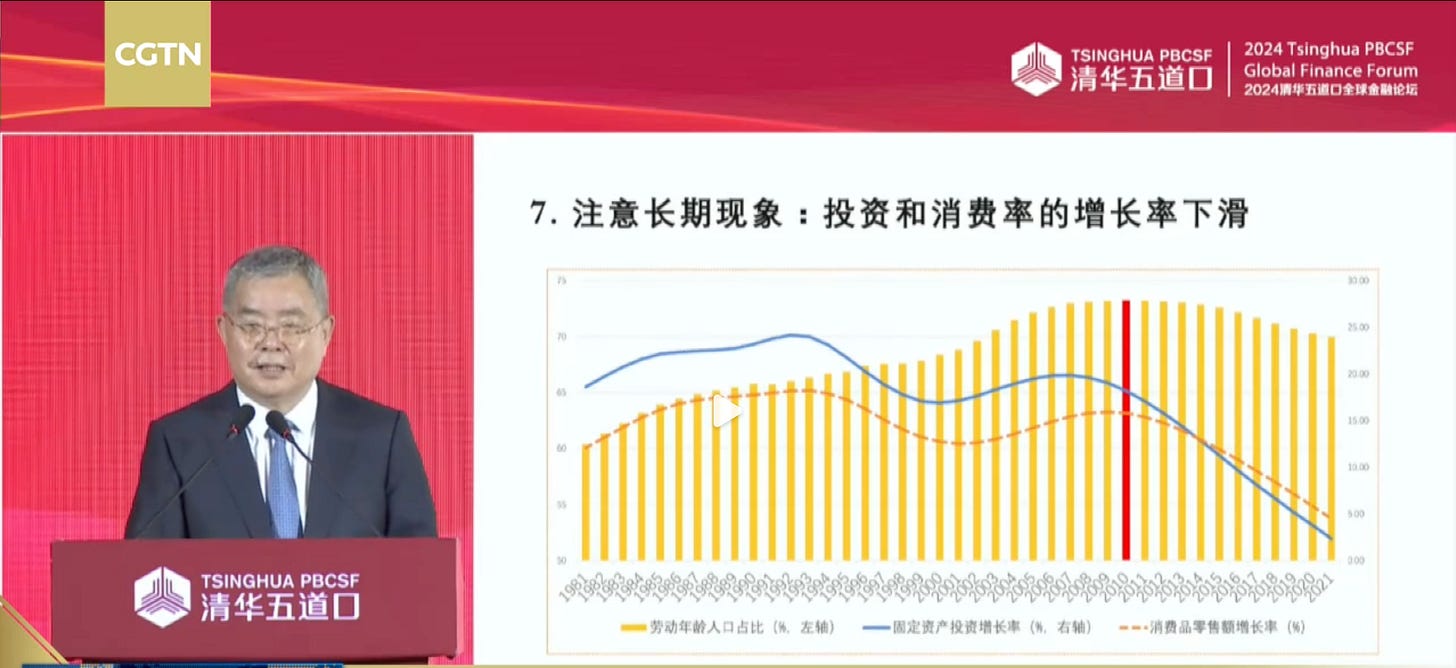

After discussing financial issues, let's move on to the real economy. Our primary concern is the declining investment rates and consumption rates. This chart clearly shows the decline, with the turning point being the red column. The red column marks the significant changes in China's population structure, with participation rates dropping.

Recently, General Secretary Xi Jinping has frequently mentioned population issues. Our research follows this logic: if financial issues cannot be explained, we turn to economic factors; if economic factors cannot explain them, we consider demographics, technology, and institutions, explaining the fundamental constraints on economic and financial development.

Finally, this chart, published by the International Monetary Fund in April, shows slight changes compared to March, somewhat unfavorable to China.

Earlier, it was mentioned here that the world is recovering, with China as the main driver.

Now, China's growth in emerging markets is projected to decline in 2023, 2024, and 2025, a perilous prediction for us.

[Slide’s title: slow recovery of the global economy.]

However, we remain confident under the strong leadership of the Communist Party of China Central Committee with Comrade Xi Jinping at its core. 实体经济的问题要靠改革、要靠开放,不能够太多的依赖金融手段,也不能太多的依赖财政手段 Addressing real economy issues requires reform and opening up, not overly relying on too many financial or fiscal measures. It is up to the revitalization of the real economy!

Recently, General Secretary Xi Jinping held a symposium on reform and opening up, releasing numerous positive signals. We believe that under the leadership of the Party Central Committee with Comrade Xi Jinping at its core, our measures will reverse this trend, allowing China to continue to stand out.

Please feel free to critique and correct any inaccuracies. Thank you.

My series of reports on the “80 Years after Bretton Woods: Building an International Monetary and Financial System for All” & 2024 Tsinghua PBCSF Global Finance Forum held in Hangzhou on May 27-28, 2024.