How Chinese TVs chip away at U.S. market shares

Story of Tomson Dongsheng Li and TCL, the world's No.2 TV maker.

China's TCL Industries is the world's No.2 TV maker, according to research firm Omdia. Based on the latest numbers available in August, TCL has been expanding its presence not only in the market for cheap LCD TVs but also in premium lines such as mini LED TVs, chipping away at the market share of industry leader Samsung Electronics Co. TCL accounted for 12.6% of global TV shipments in the first quarter of this year, up 0.7 percentage point from 11.9% the year prior.

Earlier in December, CCG published a report on the globalization of Chinese enterprises with TCL's 2004 acquisition of Thomson's television business as a landmark example.

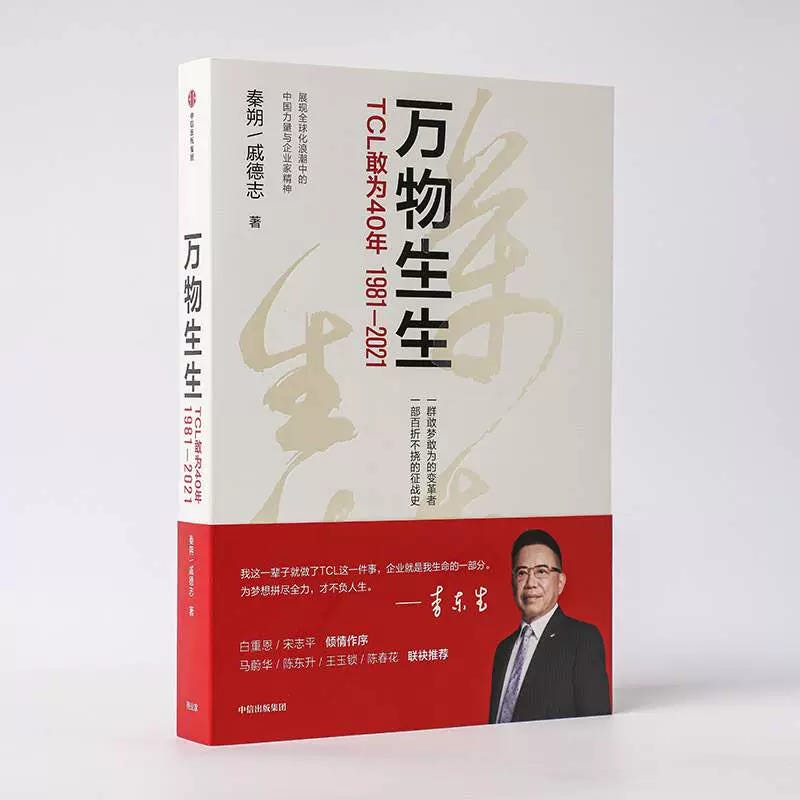

The following excerpt comes from 万物生生 From One Arises Another, a biography of TCL published in 2021, which chronicles the company's evolution from a small local business into a major player in the U.S. market. The book, authored by a team led by Qin Shuo, a popular media professional, focuses intensively on the entrepreneurship of Tomson Dongsheng Li, Founder and Chairman of TCL Technology Group Corp—the tale of "the man and his company."

Tomson Dongsheng Li is one of the most well-known entrepreneurs in China. He began his career as an engineer in TTK Home Electronic Appliances, the predecessor of TCL. In 1985, he was appointed general manager of the newly established joint venture, Telephone Communication Limited, thus creating the TCL brand. In 1996, he assumed the role of Chairman, a position he has held ever since.

This is an interesting sample of a Chinese brand entering the U.S. market—not only achieving cost-effective sales but also making a successful foray into the competitive high-end segment. Several paragraphs were omitted during translation to maintain conciseness.

Annual Sales: From 1 Million to 7.7 Million Units

At the beginning of 2015, at Harrah's Las Vegas Hotel, the TCL's manager for the U.S. market reported to Tomson Dongsheng Li, who had come to attend the annual Consumer Electronics Show (CES).

Li asked, "What's the expected output for this year?"

The manager gritted his teeth and quoted a number he felt would be safe enough so that he was not getting laid off: "Let's aim for 500,000 units."

"One million units! 500,000 won't even make the cut," said the usually mild-mannered Li.

The manager was stunned. Tomson Li continued, "In the U.S. market, if you only target 500,000 units, and those are spread across products from 32 inches to 55 inches, how can you expect your supply chain partners to back you? One million units is just the starting line. You need at least a 10% market share to build real brand influence in any market. This year's goal of one million units is actually about laying the foundation for a more efficient supply chain system, sharpening our competitive edge. Without hitting that scale, you won't even have the tools to create the system. Once you have the system in place, you can aim for the 4 million unit target, and achieve profitability, making the U.S. business turn from loss to gain."

From this exchange, the manager understood that Tomson Li's perspective was grounded in the relationship between product scale and the supply chain. Without achieving a certain level of scale, partnerships with supply chain collaborators might become shaky, prone to inconsistency, and marked by a cycle of false starts and stops. Smaller-scale efforts could crumble at the first hint of trouble.

In an interview, the manager said, "From that moment on, I realised we had to break into the mainstream channels and compete head-to-head with Samsung and LG. Back when we were doing 200,000 or 300,000 units, it was still a patchwork operation. But now, entering channels like Walmart was essential—we couldn't rely on Black Friday promotions anymore. The opportunity I saw was that mainstream channels also needed suppliers like us—those with vertical integration capabilities, stable supply, and resilience against disruptions like screen issues. We had the capacity to deliver large volumes consistently—we were very reliable."

Li said, "If you can hit 1 million units, I'll throw a celebration for you next year."

The manager replied, "Then let's book the celebration venue in advance — Ruth's Chris Steak House at Harrah's Hotel."

By the end of the year, they had completed 1.01 million units.

How did they achieve that?

First, expand the channels.

The first step was breaking into Walmart’s regular brand lineup. In the U.S., retail channels are highly concentrated, dominated by powerful players that emphasise operational efficiency and a focused brand portfolio. This means the number of brands a retailer accepts is strictly limited, forcing brand owners to compete for spots on their shelves.

As expected, once TCL entered Walmart, it quickly gained ground by capitalising on its highly efficient production and cost-effective offerings. TCL's market share within Walmart rapidly reached the maximum allocation allowed for a single supplier.

Alongside its high-performance, cost-effective mid-range and budget products, TCL also set its sights on the high-end segment and premium retail channels. With its foothold in Walmart and Amazon secured, TCL expanded to other retail giants like Costco and Sam's Club, while also establishing a comprehensive partnership with the high-end channel Best Buy.

Second, launch differentiated products.

TCL differentiated itself from competitors by focusing on two key aspects: picture quality and user-friendliness. TCL paid close attention to the high labour costs in the U.S. to hone its user-friendliness. For example, when a television is sold for $200, the installation fee could be as high as $300. Understanding this, the TCL North American team thoroughly examined every step of the customer journey—from selecting a TV and transporting it to unpacking, setup, and wall mounting. They meticulously researched and refined each step of the process, collaborating closely with colleagues in production and R&D in China. As a result, TCL was able to offer an increasingly seamless, efficient, and hassle-free experience.

Third, improve inventory turnover efficiency.

In the early days, TCL grappled with substantial losses every time panel prices fluctuated significantly. To mitigate this, the head of the U.S. market proposed a bold strategy: reducing inventory in the U.S. and accelerating turnover. The most radical step involved shipping large volumes of products directly to major channels like Walmart straight from Chinese ports. This meant TCL maintained zero inventory for these customers in the U.S., and payments were collected immediately upon delivery at the port based on agreed payment terms. This approach remained in place until 2018.

"Enhancing the turnover efficiency of current assets, drastically cutting inventory, and minimising depreciation losses were critical factors in turning a profit in the U.S. market," Tomson Li recalled. "In the beginning, our gross profit from the U.S. business was razor-thin, and making money was incredibly challenging."

Fourth, improve service by building an in-house after-sales service system.

Before August 2015, TCL relied on third-party operators for its after-sales service in the U.S. However, to cut costs, these third-party providers compromised on service quality. As TCL's sales grew, so did customer issues, and the outsourced service struggled to meet demand. In August 2015, TCL launched its own customer service system, connecting North American users directly to a dedicated call centre in Manila.

TCL implemented an extensive training program for call centre staff, ensuring they understood not just the technical aspects of the TVs but also the typical home environments in which they were used. This training enabled staff to better identify customer needs across different scenarios. Rather than simply resolving issues as they arose, agents began proactively guiding users, highlighting potential problems they might encounter and providing tips to fully enjoy the TVs' features.

This shift led to a rapid increase in customer satisfaction, with return rates dropping significantly. Customers particularly praised the ease of use and installation. Users particularly appreciated the ease of installation and overall user-friendliness.

Under the previous third-party system, customers were required to pay for return shipping and wait over a week for a repaired unit. TCL's new system streamlined this process. For TVs that failed within 50 days of purchase, TCL would ship replacements directly to customers, with the company covering the return shipping. For products older than 50 days, the company would provide a repaired unit for temporary use while the defective one was fixed.

Through these changes, many customers who initially left negative reviews on Amazon quickly updated their comments, saying, "My earlier review was due to not knowing this brand well, but now I'm convinced it has what it takes to succeed." Such comments became very common.

In addition, TCL implemented a Customer Relationship Management (CRM) system in North America, leveraging multiple communication channels to engage with customers. Feedback on product quality, usage, and overall experience was swiftly shared with internal departments, enabling continuous improvements in product design and quality.

TCL encountered two major quality incidents in the U.S. market, and Tomson Li enforced very strict disciplinary actions on those responsible.

"Doing business in the U.S. market is very tough," Li reflected. "It's like walking on thin ice—you must stay vigilant at all times. Any carelessness could lead to unexpected losses and undo all previous efforts." From his experience in the U.S. market, Li emphasised that superior product quality is non-negotiable. The actual return rate should not exceed 1%, and any user customer must be resolved through the call centre, or else the business will inevitably incur losses.

2015 was a breakthrough year for TCL in the U.S. market, with TV sales surpassing 1 million units for the first time. In the following years, TCL's sales in the U.S. grew significantly year by year, with substantial increases each time. Today, TCL has cemented its position as one of the top two TV brands in the U.S., second only to Samsung.

In 2015, TCL officially entered the Walmart channel, which at one point accounted for more than half of TCL's sales. The fast turnover and high sales volumes were undeniable advantages, but this heavy reliance on a single channel also presented risks. In the U.S., retail giants like Walmart and Amazon hold tremendous power over suppliers, including the ability to set retail prices, and it's illegal for suppliers to interfere. Therefore, TCL needed to pursue a multi-channel strategy for balanced growth.

In 2017, TCL entered the high-end chain Best Buy's offline channels. While competition in Walmart centred on cost-effectiveness, TCL had to focus on premium capabilities in Best Buy's channels, emphasising large sizes, high picture quality, and exclusive products designed specifically for this channel. In early 2019, TCL launched the world's first mass-produced 8K quantum dot TV at Best Buy.

By this point, TCL had successfully entered all six of the major retail channels in the U.S.—Target, Costco, Amazon, Sam’s Club, Best Buy, and Walmart—which together dominate 80% of the U.S. TV market. With additional regional retail stores, TCL achieved over 90% retail coverage in the U.S.

Market research firms and media outlets now no longer categorise TCL as part of the “others” category but compare it alongside top-tier Japanese and Korean brands.

TCL's Approach in the U.S. Market: Tailored Strategies for Each Channel

The global TV market totals approximately 240 million units annually, with the U.S. standing as the largest single market outside China, accounting for around 40 million units each year. The EU market is of a similar size but fragmented across more than 20 countries, each with distinct characteristics.

The U.S. TV market is dominated by six major retail channels, each with its own unique features.

TCL's entry into the U.S. began with Walmart, a mass-market retailer targeting middle- and lower-income consumers. With about 3,300 stores nationwide, Walmart offers the widest branch coverage in the country. Walmart's hallmark is "Every Day Low Prices," helping consumers save as much as possible.

Amazon, a purely online channel, holds around 10% of the U.S. TV market. Amazon operates both a vendor model (similar to JD.com's third-party vendor model) and a seller model (like Taobao's seller-driven marketplace). Compared to other retail platforms, Amazon is relatively accessible for brands. It offers a centralized platform where vendors can set up their own storefronts, and Amazon facilitates bulk procurement. Many Chinese third-party brands have entered Amazon through this model, claiming to have established a presence in the U.S. market.

In 2015, TCL entered Costco, a membership-based retail club with over 600 stores across the U.S. Catering to a mid-to-high-income demographic, Costco requires customers to hold a membership to shop. Costco emphasises offering a curated selection of products with limited SKUs (stock-keeping units). For each category, Costco may have only three or four brands, and sometimes as few as one or two.

Sam's Club was a similar chain to Costco, but with home appliances taking up a very small share of the overall sales.

Around the same time as entering Costco and Sam's Club, TCL also gained entry into Target, a high-discount boutique retailer.

The final piece of TCL’s U.S. retail strategy fell into place with its entry into Best Buy, the leading professional electronics and appliance retailer in the U.S. Despite having only 1,100 stores—about one-third of Walmart’s footprint—Best Buy dominates TV sales in the U.S. Known for its focus on technology, expertise, and premium products, Best Buy emphasises large screens and advanced features, making it a pivotal channel for TCL’s high-end market push.

The last of the six major channels that TCL entered was Best Buy, the leading professional electronics and appliance retailer in the U.S. known for its focus on technology and expertise. Despite having only 1,100 stores—about one-third of Walmart's footprint—Best Buy is the top retailer in the U.S. for TV sales.

Best Buy's influence and appeal come with high marketing expenditure requirements for brands. Regardless of annual sales, brands must invest nearly $20 million in marketing expenses just to meet Best Buy's basic threshold. Without strong products or brand credibility, even if a brand manages to get into Best Buy, it will often see poor sales results.

Best Buy is particularly stringent about picture quality and performance, frequently inviting third-party organisations to conduct independent tests. Tomson Li noted, "In recent years, TCL, Samsung, and Sony have alternated as leaders in third-party tests for various technical metrics, with TCL often securing the top spot. This has significantly enhanced TCL’s market reputation and brand influence. The rigorous scrutiny from U.S. consumers regarding picture quality and performance has in turn served as a catalyst for TCL, driving the company to continuously refine its product technology and achieve broader technical advancements."

Each time Tomson Li visits the U.S., he makes it a point to engage with consumers in retail channels. He found that American consumers are not very loyal to brands; they are pragmatic and will buy whatever product is best. While brands do have some influence, it is far less pronounced than in other markets. When it comes to TV sales, the mid-range segment dominates TV sales in the U.S. In other words, U.S. consumers value cost-effectiveness over brand recognition.

In terms of specific preferences, American consumers are particularly focused on the overall product experience, emphasising usability, operation, and especially picture quality. However, they care less about a TV's thickness, weight, or aesthetics. Even if a TV is slightly thicker or less attractive, as long as the picture quality is excellent and the price-performance ratio is high, they don't mind.

"This is the characteristic of a mature market," said Li, "consumers are highly rational and carefully analyse the performance, specifications, and other tangible aspects of the product."